Ranch insurance done right.

Right when you need it. Right where you are.

OUR STORY

Continuing a Family Tradition

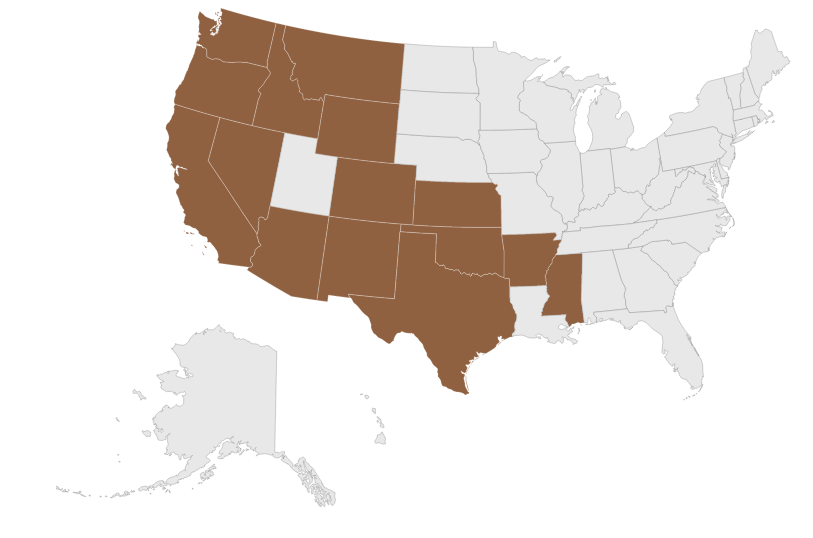

Farming and ranching has been in the Hargrove family for over 5 generations. Raford Hargrove began selling crop insurance in 1983 to offset years of bad crops and low prices. In 2006, we began servicing USDA’s Pasture, Rangeland, and Forage (PRF) program to ranchers across the nation.

Preserving Family Farms & Ranches for Future Generations

For generations, our family has endured the struggles and the joys of farming and ranching. We know the hardships of droughts and unpredictable markets, the pleasures of a warm sunrise and a good rain, and the beauty of a newborn calf. We strive to preserve family farms and ranches by combining our long held values with subsidized USDA programs, individualized policies, and industry-leading software.

Protecting Your Past, Present, & Future

The agents at Hargrove Ranch Insurance specialize in PRF and strive to do it better than anyone in the country. Each year, we sit down with each and every rancher we serve and comprehensively review their policies. We are here to serve you and your family; for this generation, the next, and those yet to come.

OUR PEOPLE

We have always felt honored to serve people in production agriculture and to help them make better, more informed risk management decisions. We have a farming and ranching heritage and share your values of faith, hard work, family, and generational land stewardship. But just as important, we have a commanding use of technology to help you evaluate available programs and to leverage these programs to improve the profitability of your operation.

To view more info about our agents and support staff, click or tap on their pictures.

AGENTS

SUPPORT STAFF

PRODUCTS & SERVICES

At Hargrove Ranch Insurance, we specialize in USDA programs that can be used to manage many of the risks involved in ranching, including lack of rainfall, failed hay/forage crops, and volatile cattle prices.

MOBILE APP

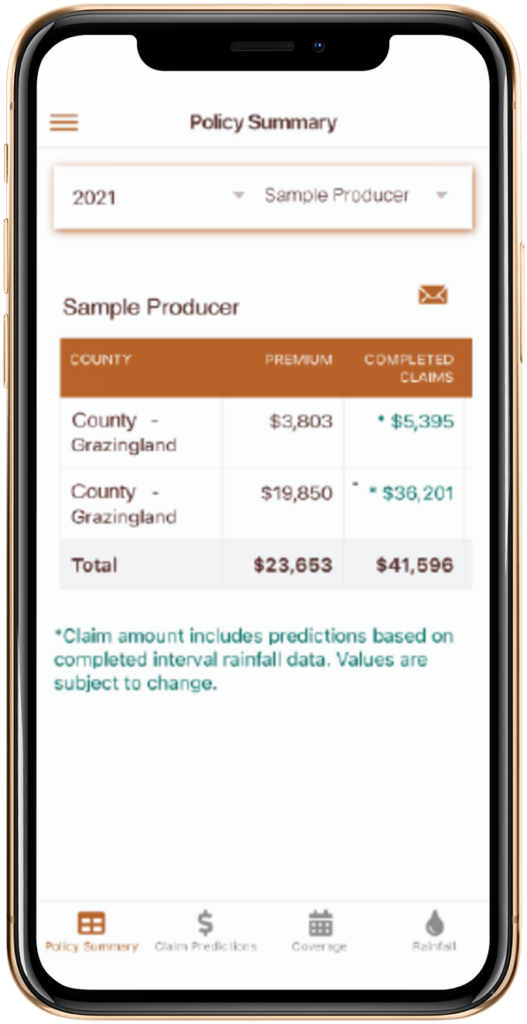

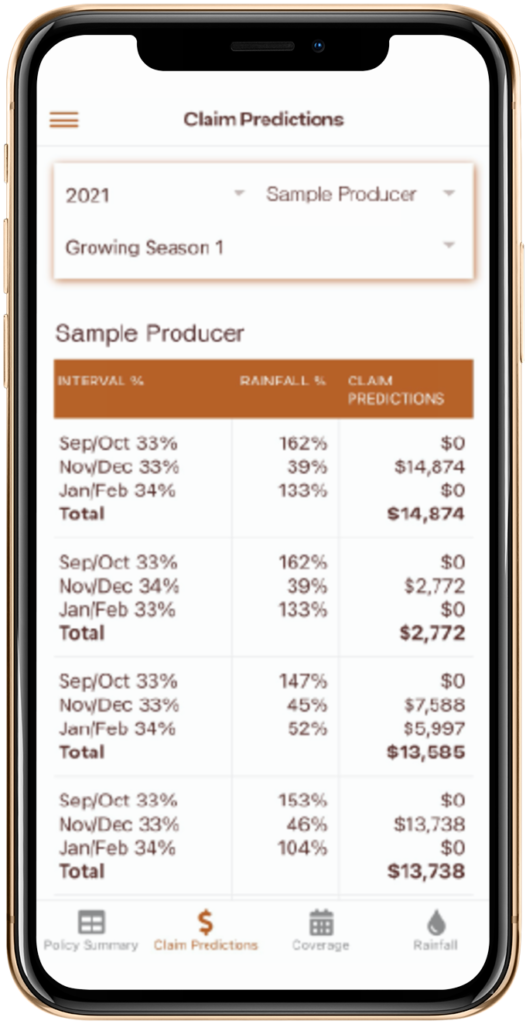

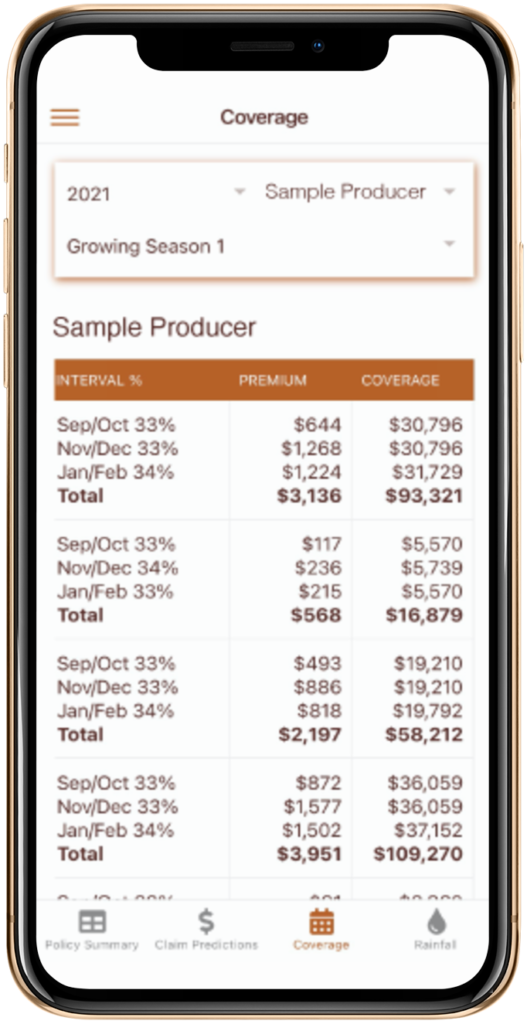

Hargrove Ranch Insurance has partnered with Ag Innovations to provide our clients a mobile app that offers quick access to important policy data and claims predictions based on current weather events.

FREQUENTLY ASKED QUESTIONS (FAQS)FAQs

WORDS FROM RAFE

Watch Rafe Hargrove's keynote address at the 2025 TSCRA Convention (starting ~2:20).

Watch Rafe Hargrove introduce keynote speakers at the 2024 TSCRA Convention.

Watch Rafe Hargrove introduce former White House Press Secretary Dana Perino at the 2023 TSCRA Convention.

FROM THE FIELD

Hargrove Ranch Insurance covers farmers and ranchers all over the country. Here are some photographs from out in the field to bring our view to you. Visit our Flickr photostream for more from the field photographs!

CONTACT US

Call us, email us, send a message, or find us on facebook anytime to get a quote, help, or discuss your farm's risk management needs.